Coinbase Warns Bitcoin Under Pressure, Citing ETF Outflows and Whales Exit

Coinbase Institutional has issued a stark warning to traders as Bitcoin breaks by means of important assist ranges, citing a number of bearish indicators, together with huge ETF outflows, whale distribution, and compressed valuations of digital asset treasuries.

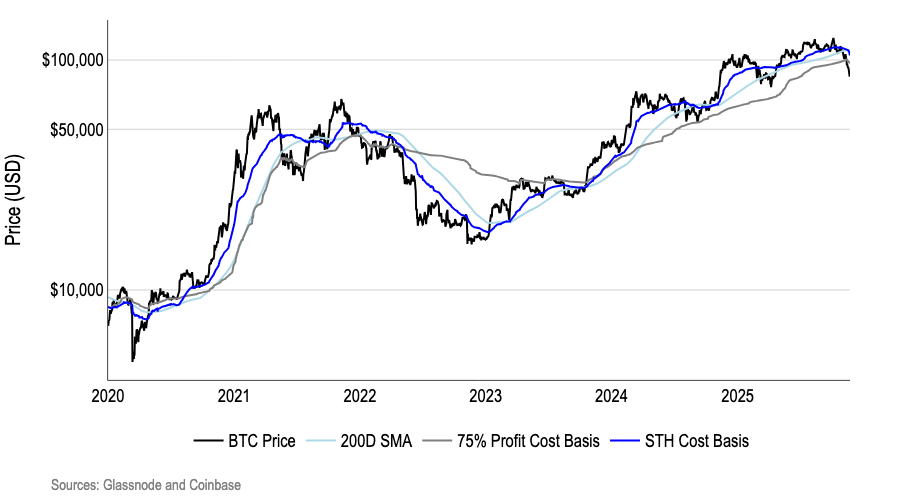

The evaluation comes as BTC trades decisively beneath its 200-day shifting common following a 32% drawdown from latest highs above $126,000, with the crypto now testing assist close to $93,000.

The alternate’s newest market evaluation reveals a confluence of detrimental components weighing on Bitcoin’s value motion.

“In this setting, we predict larger chance setups favor breakout trades over knife-catching,” Coinbase said in a latest submit, advising warning at the same time as quantitative tightening ends and the Federal Reserve re-enters bond markets.

Critical Support Levels Shattered Across Multiple Metrics

Bitcoin has systematically damaged by means of each main technical and on-chain assist band that has traditionally anchored bull-market rallies.

According to Coinbase November report, the crypto now trades beneath its short-term holder value foundation and the 75% revenue threshold that offered assist in earlier cycles, leaving no apparent flooring for costs.

The $98,000-$100,000 battleground, which beforehand represented a thick band of holders anchored to that degree, collapsed as the worth sliced by means of with minimal rebound makes an attempt.

Recent consumers are underwater, with realized losses spiking to ranges final seen throughout the November 2022 FTX collapse.

This creates elevated capitulation danger as short-term holders rush to chop losses reasonably than maintain by means of the downturn.

The swift drop by means of the $90,000-$85,000 vary confirmed the shortage of natural demand to mitigate declines, with cost-basis distribution scaling down beneath present ranges.

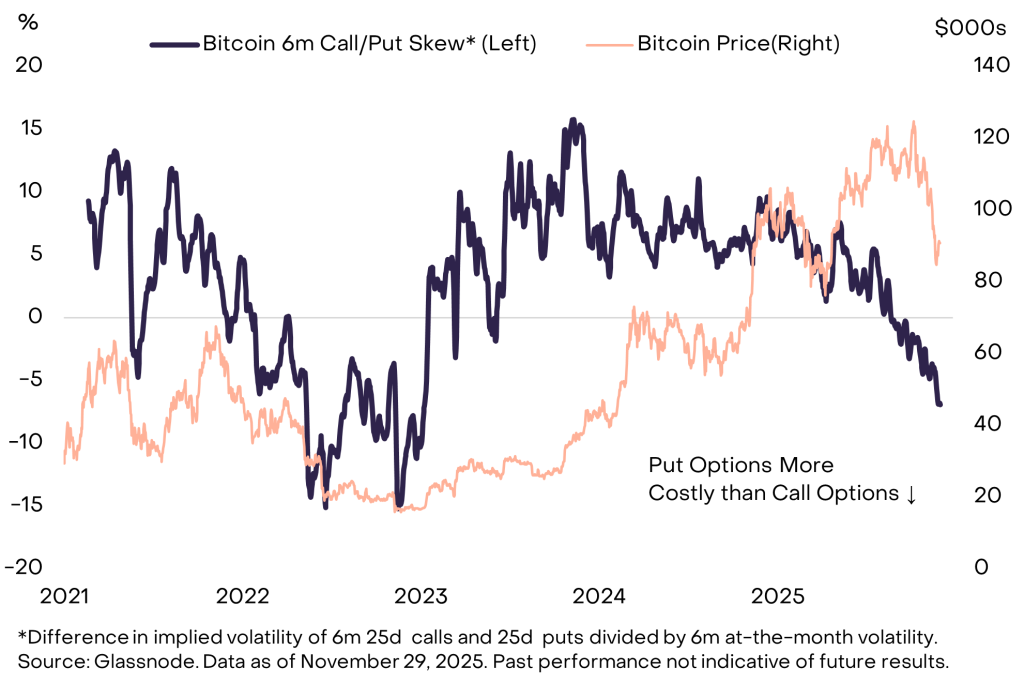

Options markets have additionally shifted from cautious to outright defensive, with the Bull-Bear Index turning firmly detrimental throughout brief and mid-term tenors.

Traders are paying premiums for draw back safety reasonably than upside publicity, whereas long-dated choices hover close to impartial, suggesting structural uncertainty reasonably than deep pessimism.

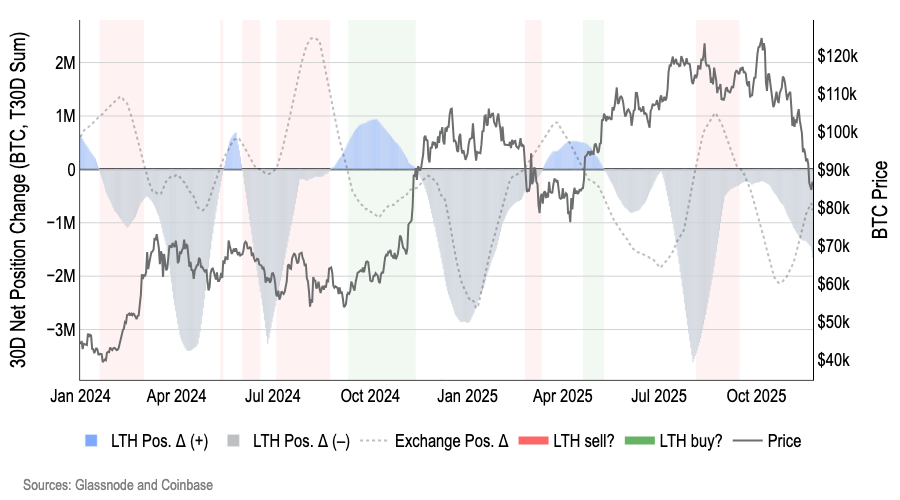

Meanwhile, long-term holder internet place adjustments have turned decidedly detrimental on a 30-day foundation, with market intelligence agency Arkham figuring out not less than one early Bitcoin whale who absolutely exited an 11,000 BTC place price roughly $1.3 billion between late October and November.

ETF and Treasury Demand Evaporates

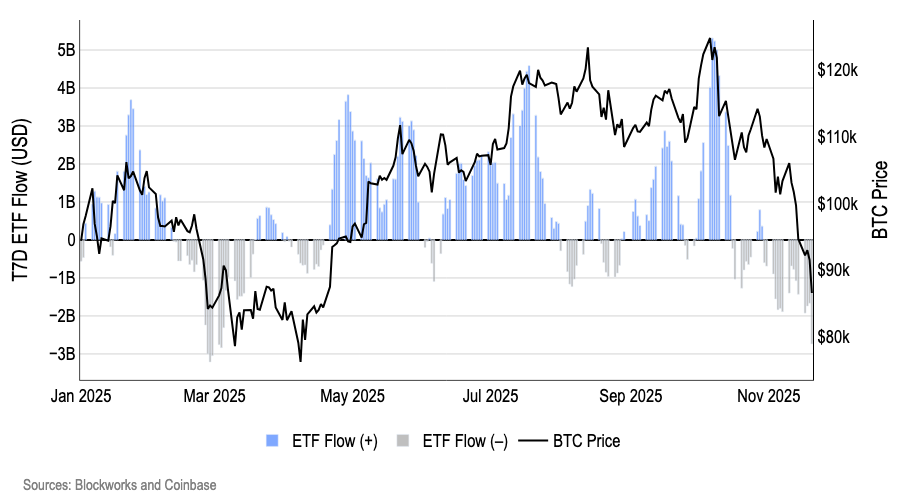

Spot ETF flows, beforehand a dominant incremental purchaser, have reversed course dramatically.

November 2025 posted file cumulative internet outflows because the trailing seven-day sum turned markedly detrimental after the worth broke key ranges.

When allocators redeem ETF shares, issuers should promote spot Bitcoin or cut back hedges, amplifying broader risk-off episodes.

US spot Bitcoin ETFs now handle $168 billion in property, holding roughly 1.36 million BTC, representing 6.9% of the circulating provide.

Digital asset treasury demand has equally cooled, with firms’ market worth over internet asset worth compressing beneath parity for the primary time since 2024.

Multiple treasury automobiles now commerce at reductions to their Bitcoin holdings, creating latent danger as shareholders might stress administration to gradual purchases, hedge publicity, or monetize holdings.

This stress manifests as firms, together with Strategy, set up money reserves, with Strategy announcing a $1.44 billion reserve covering 21 months of obligations whereas updating fiscal steerage to venture working outcomes starting from a $7 billion loss to a $9.5 billion acquire, relying on year-end Bitcoin costs.

The shift comes forward of MSCI’s January 15, 2026, decision on whether or not to exclude firms holding greater than half their property in crypto from international indices.

JPMorgan estimates this might set off compelled institutional promoting between $2.8 billion and $8.8 billion.

Stablecoin Liquidity Contracts

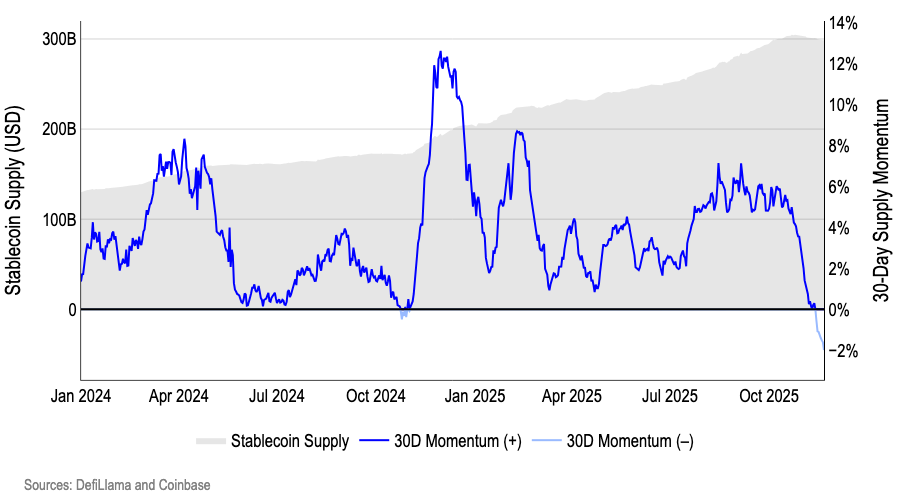

Crypto-native greenback liquidity is rolling over as combination stablecoin provide contracts following regular development by means of October.

The 30-day momentum has posted its weakest studying since 2023, with shrinking provide reflecting deleveraging and capital leaving on-chain rails for fiat or safer property.

While stablecoins reached a file of over $300 billion in circulation, the latest contraction alerts diminished “dry powder” obtainable to chase rallies regardless of stablecoins processing $225.6 billion in every day switch quantity.

Despite these headwinds, Grayscale Research has recently challenged widespread pessimism, arguing that Bitcoin’s present market construction basically differs from earlier cycles.

The asset supervisor contends that dominance by exchange-traded merchandise and company treasuries reasonably than retail exchanges means Bitcoin received’t comply with historic patterns of deep, extended declines.

Technical indicators, together with elevated put possibility skew and on-chain dealer capitulation, counsel backside formation could also be underway, with accumulation patterns persevering with amongst massive holders.

The submit Coinbase Warns Bitcoin Under Pressure, Citing ETF Outflows and Whales Exit appeared first on Cryptonews.

(@CoinbaseInsto)

(@CoinbaseInsto)  Strategy Inc builds a $1.44B USD Reserve and revises its 2025 steerage as BTC swings sharply

Strategy Inc builds a $1.44B USD Reserve and revises its 2025 steerage as BTC swings sharply