Why Is Crypto Down Today? – January 29, 2026

The crypto market is down at this time. After a single day of will increase, it fell 1.7% over the previous 24 hours to the present $3.06 trillion. Also, 90 of the highest 100 cash fell on this interval. The complete crypto buying and selling quantity stands at $124 billion.

Crypto Winners & Losers

On Thursday morning (UTC), 9 of the highest 10 cash per market capitalisation have seen their costs lower.

is down 2.5%, altering arms at $2,942.

The highest drop on this class is Dogecoin (DOGE)’s 4.5% to $0.1214.

It’s adopted by Solana (SOL)’s 3.4% fall to the value of $122.

Binance Coin (BNB) noticed the smallest drop, 1%, now buying and selling at $896.

At the identical time, the one improve among the many high 10 is 0.8% by Tron (TRX), now buying and selling at $0.2945.

Furthermore, of the highest 100 cash per market cap, 90 have posted value decreases at this time.

Pump-fun (PUMP) fell essentially the most, with the one double-digit drop of 10% to $0.003001.

River (RIVER) is subsequent, having dropped 7.3% to the value of $50.56.

On the inexperienced aspect, Worldcoin (WLD) appreciated essentially the most on this class. It’s up 5.4% to $0.4898.

PAX Gold (PAXG) is subsequent, rising 4.7% to $5,540.

The day’s lower follows a hawkish-leaning US Federal Reserve, lack of fresh capital, and geopolitical stress.

Reinforcing Consolidation

Gracy Chen, CEO at Bitget, commented on the US Federal Reserve’s determination to carry rates of interest regular at 3.50%–3.75% throughout its first coverage assembly of 2026. This was as anticipated and in line with market pricing, Chen says.

Moreover, fee cuts are unlikely till later within the yr, supplied there’s no clear weak point in financial knowledge.

A rate-hold preserves present liquidity and helps threat belongings with out tightening monetary circumstances additional – so it might be constructive for the crypto market within the close to time period. Maintaining stability whereas monitoring incoming knowledge helps Bitcoin’s and Ethereum’s resilience and “broader crypto adoption below a macro regime that has but to sign aggressive tightening.”

Currently, BTC and ETH have traded “comparatively flat, holding key psychological ranges as merchants reassess threat urge for food and positioning somewhat than instantly reacting to a coverage shift.”

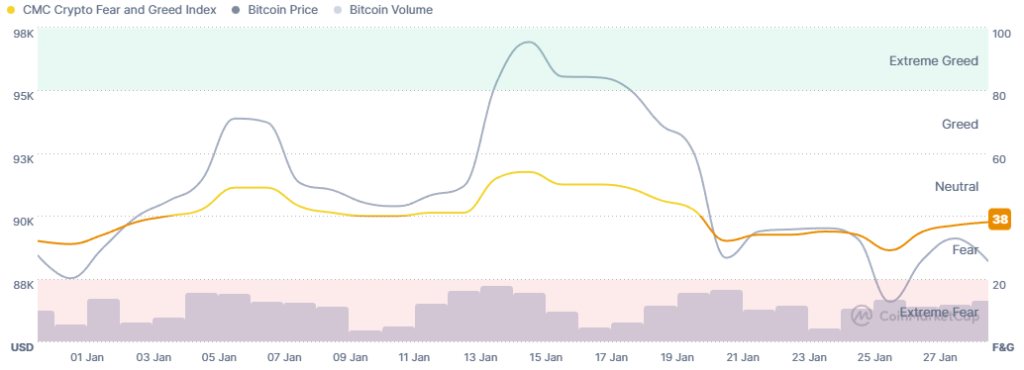

Per Chen, “Bitcoin is prone to hold consolidating within the $88,000–$91,000 vary, with makes an attempt to interrupt out towards the $95,000 psychological stage.”

But each of those cash may benefit from the regular US coverage, she argues. This atmosphere might “assist maintain threat urge for food” and reinforce BTC’s and ETH’s “roles as hedges in opposition to medium-term financial pressures and greenback debasement narratives – significantly if future knowledge factors counsel easing later in 2026.

Jimmy Xue, co-founder and COO of Axis, commented {that a} sign that Quantitative Tightening (QT) will persist at present ranges, regardless of political strain, might act as a ceiling for threat belongings.

The ‘debasement commerce’ would stay the first driver. And “any perceived lack of Fed independence amid ongoing DOJ scrutiny might mockingly present the ground that crypto wants, even when rates of interest stay greater for longer,” Xue says.

Providing Necessary Market Reset

Fabian Dori, CIO at Sygnum Bank, says that markets are arrange for a holding sample, not a coverage pivot. This was confirmed by the FOMC assembly.

The assembly final result was “all the time extra prone to reinforce consolidation than set off a directional break. The subsequent factor to look at is whether or not the rising political overhang round Fed independence begins to point out up extra explicitly in Fed communication, and in how markets value coverage threat.”

Meanwhile, Nic Roberts-Huntley, CEO and co-founder of Blueprint Finance, argued that “the underlying market construction for digital belongings is arguably more healthy than it was throughout the leverage-fueled peaks above $125,000.”

Importantly, this era of consolidation permits for a crucial reset, he says.

Per Nic Roberts-Huntley, “shifting the main focus from speculative froth again to long-term fundamentals and the potential for a renewed rally as soon as macro readability improves. Looking forward, the interaction between fiscal coverage and the central financial institution’s eventual pivot will stay the first driver for risk-asset sentiment by way of 2026.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC was altering arms at $87,820. The day started at $90,315, however the coin has progressively dropped beneath the $90,000 stage and to the intraday low of $87,653.

Over the previous week, BTC fell 2.4%. It traded between $86,319 and $90,475 throughout this era.

Failing to remain above $86,000 would take BTC again to $85,300 after which to the $83,000-$84,000 zone.

Bitcoin has slipped beneath $89,000 as a hawkish-leaning Federal Reserve and Middle East tensions sap threat urge for food.

Bitcoin has slipped beneath $89,000 as a hawkish-leaning Federal Reserve and Middle East tensions sap threat urge for food.

News: Sygnum and Starboard Digital elevate over 750 BTC for BTC Alpha Fund

News: Sygnum and Starboard Digital elevate over 750 BTC for BTC Alpha Fund First regulated financial institution globally to supply market-neutral…

First regulated financial institution globally to supply market-neutral…