Why Is Crypto Up Today? – January 12, 2026

The crypto market is up at the moment, although barely, with the cryptocurrency market capitalisation rising by 0.6%, and at the moment standing at $3.2 trillion. At the time of writing, 63 of the highest 100 cash have gone down over the previous 24 hours. Also, the whole crypto buying and selling quantity stands at $87.2 billion, fairly decrease than what we’ve been seeing over the previous few weeks.

Crypto Winners & Losers

With the start of the brand new week, on the time of writing on Monday morning, 4 of the highest 10 cash per market capitalisation have seen their costs fall over the previous 24 hours, whereas 4 have posted features in the identical timeframe (not taking the stablecoins under consideration).

elevated by 1.2%, now buying and selling at $3,128.

The class’s largest gainer is Solana (SOL), which posted a 3.6% improve to $141.

It’s adopted by Lido Staked Ether (STETH), having gone up 1.3% to the worth of $3,124.

On the crimson facet, the very best drop is XRP (XRP)’s 2.1%, now buying and selling at $2.05.

Dogecoin (DOGE)’s 2% fall to $0.1368 is subsequent, adopted by Binance Coin (BNB)’s 1.2% and Tron (TRX)’s 0.2%, buying and selling at $902 and $0.2977, respectively.

When it involves the highest 100 cash per market cap, one posted a double-digit drop. Pol (POL) is down 11.3% to $0.1584.

It’s adopted by Provenance Blockchain (HASH), which declined by 9.5% to the worth of $0.02155.

The remainder of the crimson cash are down beneath 5% every.

At the identical time, three cash on this class recorded double-digit will increase. Monero (XMR) appreciated 18.1% to $569.

Canton (CC) appreciated 10.9%, at the moment altering fingers at $0.1459. It’s adopted by MYX Finance (MYX)’s 10.2% to the worth of $5.51.

Meanwhile, Coinbase stated it might withdraw support for major crypto legislation if the US Senate negotiators add restrictions on stablecoin rewards past disclosure necessities. This has elevated tensions forward of the markup scheduled for 15 January.

On the opposite facet of the world, South Korea may be ending its nine-year ban on company crypto funding. It’s forming with new pointers that can allow listed corporations {and professional} traders to commerce crypto.

‘BTC is Highly Sensitive to Institutional Risk’

Petr Kozyakov, Co-Founder and CEO at Mercuryo, commented that BTC “has surrendered early features after breaching the $92,000 mark in Asia buying and selling as the largest cryptocurrency mirrors main US tech shares in a risk-off mode retreat.”

Markets look like weighing rising tensions between US Federal Reserve Chairman Jerome Powell and President Donald Trump. Against this backdrop, and amid escalating geopolitical dangers, merchants are retreating to safe-haven property resembling gold and silver, the CEO writes.

“Meanwhile, within the digital token area, the narrative of accelerating inflows into privateness cash, which so outlined the ultimate months of 2025, is constant to play out with Monero and Zcash recording features of 16 per cent and 4 per cent, respectively,” Kozyakov concludes.

Bitunix analysts famous that the U.S. federal prosecutors have launched a legal investigation into Federal Reserve Chair Jerome Powell.

From a macro perspective, they write, this isn’t merely an remoted authorized danger. This is “a direct problem to one of many core assumptions underpinning market pricing: the political neutrality and coverage independence of the central financial institution.”

“The key concern shouldn’t be whether or not the prosecution in the end succeeds, however whether or not markets start to imagine that the Federal Reserve is not absolutely insulated from politics. Once that perception is shaken, world asset pricing frameworks have to be reassessed,” the analysts argue.

Moreover, “Bitcoin is very delicate to such institutional danger. When confidence in greenback credibility and central financial institution independence is questioned, decentralized property are inclined to obtain narrative-driven danger premia.”

They proceed: “In the quick time period, heightened danger aversion helps BTC’s relative draw back resilience; within the medium time period, consideration ought to be paid as to if U.S. equities expertise a broader systemic correction; over the long run, if political interference in financial coverage turns into structural, Bitcoin’s function as a “non-sovereign danger asset” is prone to be additional bolstered.”

Levels & Events to Watch Next

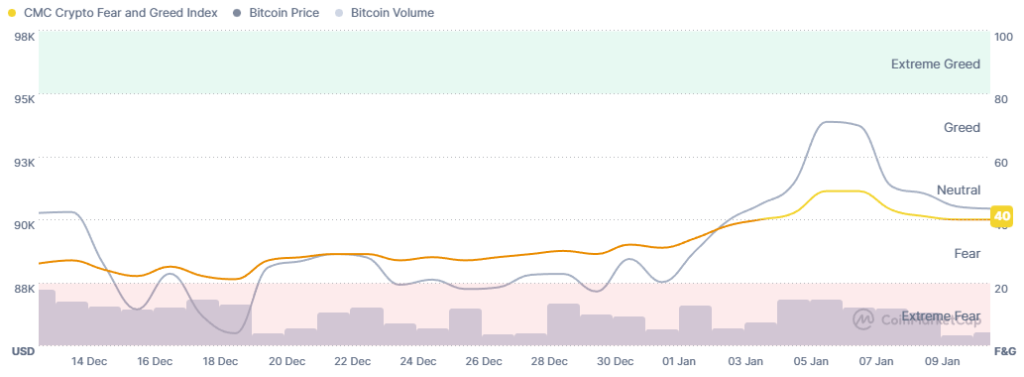

At the time of writing on Monday morning, BTC stood at $91,271. The coin traded largely sideways for the primary a part of the previous day. It then swiftly dropped to the intraday low of $90,244 earlier than rising to the day’s high of $92,356. It has corrected decrease once more since.

Over the previous week, BTC traded within the $89,799 – $94,420 vary. Overall, it decreased by 2.1% over this timeframe.

A detailed above $91,520 could open doorways for a transfer to $93,011, adopted by $94,800, which might current the subsequent upside check. A failure to carry above the $91,000 degree may lead to a pullback to $89,241 and $87,921.

(@faryarshirzad)

(@faryarshirzad)

CryptoQuant studies that the $79,000 degree is a crucial help space for Bitcoin.

CryptoQuant studies that the $79,000 degree is a crucial help space for Bitcoin.