Why Is Crypto Up Today? – January 27, 2026

The crypto market is up at present – however simply barely. The cryptocurrency market capitalisation is up by simply 0.1% over the previous 24 hours by the point of writing, which means it’s largely unchanged. It nonetheless stands at $3.05 trillion, the identical as yesterday. Also, 77 of the highest 100 cash posted worth will increase. Moreover, the entire crypto buying and selling quantity stands at $113 billion.

Crypto Winners & Losers

On Tuesday morning (UTC), we discover 7 of the highest 10 cash per market capitalisation up and three down (not taking stablecoins into consideration).

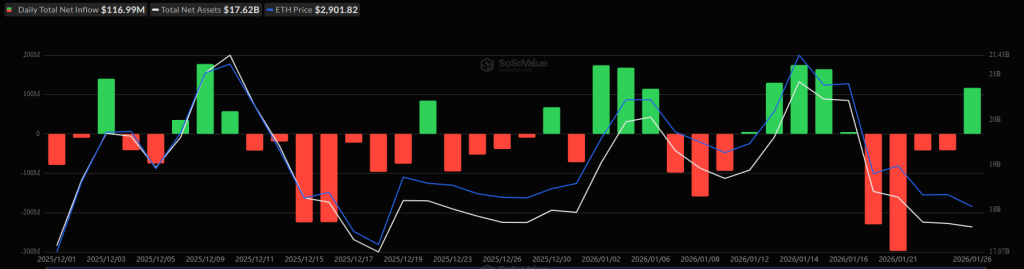

appreciated simply 0.3%, altering arms at $2,901.

The highest fall among the many prime 10 is 0.3% by Tron (TRX), now buying and selling at $0.2942.

At the identical time, Solana (SOL)’s 1% is the class’s highest improve. It at present stands at $123.

It’s adopted by Binance Coin (BNB)’s 0.6%, now buying and selling at $876.

Furthermore, of the highest 100 cash per market cap, 77 have posted worth will increase at present.

Pump.fun (PUMP) leads this listing with a 24.7% rise to $0.003134.

Next up is Hyperliquid (HYPE)’s 22.6% to the value od $27.28.

Provenance Blockchain (HASH) is the one different double-digit improve, rising 19.3% to $0.02739.

Of the purple cash, River (RIVER)stands on the prime, having plunged by 32.6%, reverting almost all yesterday’s positive factors. It now stands at $58.14.

The relaxation are down 5% and fewer per coin.

Investors throughout markets await a recent batch of tech earnings reviews coming from the US, in addition to the choice by the US Federal Reserve on rates of interest. It stays to be seen how – if in any respect – these will have an effect on the crypto market particularly.

Meanwhile, Fundstrat managing accomplice Tom Lee argued crypto fundamentals stay intact regardless of latest underperformance and that BTC and ETH could surge when the gold and silver rally begins to chill.

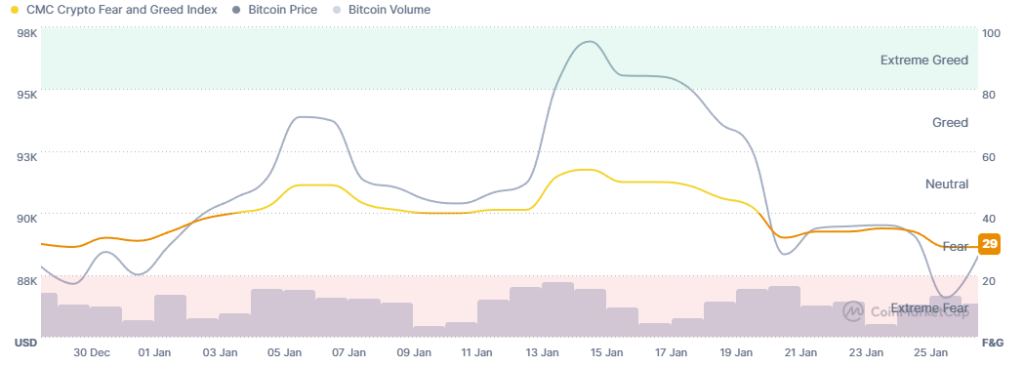

BTC’s Psychological Battleground

Petr Kozyakov, co-founder and CEO at Mercuryo, commented that BTC “stands precariously” at about $87,000. It at present “continues to teeter within the grip of bearish sentiment.” As the week started, it fell to the $86,100 stage in “frenetic Asian buying and selling.”

Moreover, markets are in risk-off mode as gold and silver surge. This exhibits that buyers are “dashing to conventional safe-haven property amid rising ranges of geopolitical danger.”

Additionally, each retail and institutional crypto buyers stay on the defensive, Kozyakov added. Retail-driven sectors and institutional participation have retreated.

Meanwhile, Jimmy Xue, co-founder and COO of Axis, argued that Bitcoin’s $90,000 pause is a “macro repricing, not a requirement breakdown.”

More exactly, the present pause is a macro-driven repricing of the low cost fee, Xue says, as “the market’s hope for an aggressive 2026 easing cycle has considerably cooled.”

The spot ETF inflows stay a resilient ground, he says. But they’re at present performing as a “passive wall” and never an energetic engine of worth discovery.

Per Xue, “the $90,000 stage has change into a psychological battleground the place macro merchants are taking income to hedge towards a restrictive Fed, whilst long-term institutional accumulators proceed to purchase the dips.”

He concludes: “A sign of Fed ‘endurance’ this week successfully removes the instant liquidity injection the market was front-running, resulting in a interval of ‘tense calm.’ In an surroundings already formed by geopolitical friction and commerce uncertainty, this lack of recent capital sometimes triggers ‘volatility by headline,’ the place skinny order books result in sharper, news-driven worth swings. Without a dovish pivot, anticipate liquidity to stay defensive and concentrated in probably the most established property.”

Levels & Events to Watch Next

At the time of writing on Tuesday morning, BTC was altering arms at $87,702. It’s been a uneven buying and selling day, particularly within the first half, with the value falling to the low of $87,180 twice. It very briefly hit the intraday high of $88,763.

BTC fell 3.8% over the previous seven days, buying and selling within the $86,319-$91,178 vary.

The $90,500-$91,200 zone now acts as resistance, having beforehand served as a assist space. If BTC falls beneath $86,400, it might transfer to $84,400. But a transfer above that stage would open doorways to $89,500, $90,500, $93,300, and $95,500.

$14 trillion BlackRock information for a brand new iShares

$14 trillion BlackRock information for a brand new iShares