Why Is Crypto Up Today? – January 28, 2026

The crypto market is up immediately. After sitting on the boundary between appreciation and drop yesterday, unchanged over the day gone by, the cryptocurrency market capitalisation noticed the inexperienced prevail, rising 2.2% over the previous 24 hours. It now stands at $3.12 trillion. Also, 90 of the highest 100 cash posted worth will increase. The complete crypto buying and selling quantity stands at $128 billion.

Crypto Winners & Losers

On Wednesday morning (UTC), 9 of the highest 10 cash per market capitalisation have seen their costs respect.

appreciated simply 3.8%, altering arms at $3,020. This is the class’s second-highest leap.

Among the most effective performers is Binance Coin (BNB), which elevated by 3.4%, now buying and selling at $905.

At the identical time, the one fall among the many high 10 is 0.7% by Tron (TRX), now buying and selling at $0.2921.

Furthermore, of the highest 100 cash per market cap, 90 have posted worth will increase immediately.

Hyperliquid (HYPE) is the day’s highest gainer, posting the class’s solely double-digit rise of 25.3% to $34.62.

Canton (CC) follows with a 9.4% improve to $0.1655.

On the purple aspect, on the high, we discover River (RIVER). It’s down 9.3% to the worth of $54.55.

Provenance Blockchain (HASH) follows, falling 7.6% to $0.02531.

The relaxation are down 3% and fewer per coin.

Meanwhile, Bitcoin jumped in early Asia trade as properly, initially seeing a uneven open. Investors have since targeted on US earnings and discussions on extra funding for OpenAI.

ETH Trading In a Key Zone

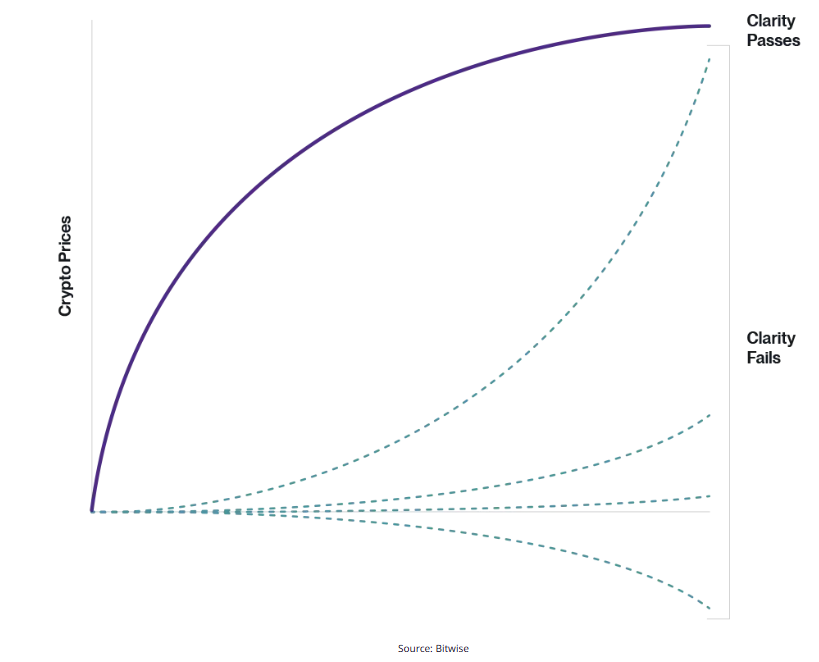

Bitwise Chief Investment Officer Matt Hougan recently said that crypto markets now have a important three-year window to show their real-world utility. Otherwise, the continuing legislative uncertainty within the US might halt trade momentum.

“If, on the finish of three years, we’re all utilizing stablecoins and buying and selling tokenized shares, we’ll get constructive crypto laws no matter who’s in cost,” Hougan wrote. “But if crypto is as an alternative nonetheless working on the sides, a change in Washington could possibly be an enormous setback.”

Glassnode analyst Chris Beamish wrote on Twitter that ETH is buying and selling in a breakeven zone for a lot of holders.

Notably, he argues that this can be a key stage on which the subsequent transfer relies upon.

“Holding right here suggests absorption and base constructing,” Beamish writes. A breakdown, nonetheless, “would transfer worth into thinner help the place underwater provide might derisk.”

Nic Puckrin, funding analyst and co-founder of Coin Bureau, argues that BTC wants the transfer above the $100,000 mark.

“The longer Bitcoin stays beneath $100,000, the extra momentum will development to the draw back,” he writes in a remark.

A brand new all-time high in 2026 isn’t out of the query but, Puckrin says, however “the subsequent 30 days will probably be essential in figuring out whether or not a bear market is already right here.”

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC was altering arms at $89,419. It began the day on the 87,990 stage, quickly reaching the intraday low of $87,315. However, it then surged to the day’s peak of $89,419.

It has turned purple within the 1-week timeframe as properly, even when barely. It’s up 0.2%, buying and selling between $86,319 and $90,475.

BTC hasn’t been in a position to break the $90,000 stage by the point of writing, however breaking it could open doorways for increased zones, beginning with $91,500-93,000. Staying above $91,200 might assist it transfer as much as $93,300 after which $95,500. Otherwise, it should return in direction of $86,000.

At the identical time, Ethereum was buying and selling at $3,020. Similarly to BTC, ETH tried a leap increased earlier within the day, from the low of $2,899 to the $2,989 stage. It, nonetheless, wasn’t in a position to maintain it this time. It plunged earlier than initiating a extra sustainable push upwards, surpassing $3,000 and hitting the intraday high of $3,028.

Over the previous week, ETH appreciated 2%, transferring within the $2,801–$3,044 vary.

ETH now has an opportunity to reclaim even increased ranges, beginning with $3,100, then $3,180 and $3,220. A bearish pullback would take it again to $2,900 and $2,840.

Moreover, the crypto market sentiment has seen a rise after a few days of sitting on the fence.

The crypto worry and greed index presently stands at 34, in comparison with 29 seen over the previous two days.

Notably, regardless of this leap, the metric stays inside the worry zone. A better surge in optimism is required to push it again into the impartial territory.

ETFs Inflows Were Short-Lived

After a minor uptick yesterday, which broke a week-long purple streak, the US BTC spot exchange-traded funds (ETFs) posted outflows once more on Tuesday. These funds let go of $147.37 million in complete on 27 January.

Therefore, the full internet influx decreases to $56.35 billion.

Of the twelve ETFs, two noticed outflows. BlackRock mentioned goodbye to $102.81 million, whereas Fidelity posted outflows of $2.79 million.

The US ETH ETFs additionally recorded outflows in the course of the Tuesday session. These totalled to $63.53 million. The complete internet influx now stands at $12.36 billion.

Of the 9 ETH ETFs, one noticed inflows, and two posted outflows. Grayscale ETH Mini Trust added $9.99 million.

However, BlackRock recorded $58.97 million in damaging flows, adopted by Grayscale’s $14.55 million.

Meanwhile, within the US, a South Dakota lawmaker has reintroduced laws that will allow the state to invest a portion of its public funds in Bitcoin.

It would amend South Dakota’s public funding statutes and allow the State Investment Council to allocate as much as 10% of eligible state funds to BTC. Moreover, the invoice would permit publicity by direct holdings, certified custodians, or regulated exchange-traded merchandise.

Quick FAQ

- Did crypto transfer with shares immediately?

The crypto market has posted the next improve over the previous 24 hours than seen a day prior. Meanwhile, the US inventory market closed the earlier session with a combined image. By the closing time on Tuesday, 27 January, the S&P 500 was up 0.41%, the Nasdaq-100 elevated by 0.88%, and the Dow Jones Industrial Average fell by 0.83%. Also, gold futures hit a brand new report, whereas their silver counterparts pulled again after a brand new high seen on Monday.

- Is this rally sustainable?

We might see costs rise additional over the next days. However, contributors shouldn’t be shocked by sudden pullbacks both, as these are regular for the market. Incoming macro indicators might have an effect on the worth motion in both route.

The put up Why Is Crypto Up Today? – January 28, 2026 appeared first on Cryptonews.

Bitcoin edged towards $89,000 in Asia, however skinny ETF inflows and lighter derivatives positioning stored merchants cautious forward of US earnings.

Bitcoin edged towards $89,000 in Asia, however skinny ETF inflows and lighter derivatives positioning stored merchants cautious forward of US earnings.