Why Is Crypto Up Today? – November 27, 2025

The crypto market is up immediately, for a fourth day in a row, with the cryptocurrency market capitalisation seeing a notable rise of 4.2%, now standing at $3.2 trillion. 88 of the highest 100 cash have gone up over the previous 24 hours. At the identical time, the overall crypto buying and selling quantity is at $159 billion.

Crypto Winners & Losers

At the time of writing, the entire prime 10 cash per market capitalization have seen their costs recognize over the previous 24 hours.

is up by 3.9%, now altering arms at $3,027. This is the third-highest rise on the record.

The second-highest is 4.2% by Binance Coin (BNB), now buying and selling at $893.

At the identical time, the smallest rise is 0.6% by XRP.

Looking on the prime 100 cash, we discover that 88 recorded will increase. Among these, two noticed double-digit rises. Kaspa (KAS) is up 20.8% to $0.06169.

Flare (FLR) rose by 11.9% to the worth of $0.01516.

On the opposite aspect, MemeCore (M) fell 30.4% to the worth of $1.27.

It’s adopted by Rain (RAIN), which decreased by 5.5%, now buying and selling at $0.007301.

Meanwhile, traders are awaiting extra knowledge from the US, which was delayed by the federal government shutdown.

Additionally, San Francisco Fed President Mary Daly and Fed Governor Christopher Waller advised that the central financial institution could transfer from holding to easing. Other knowledge means that layoffs are contained, supporting a soft landing narrative.

Moreover, Bolivia has reversed its long-standing ban on digital property. It is now making ready to combine cryptocurrencies, beginning with stablecoins, into its formal banking system.

Bulls and Bears Battling

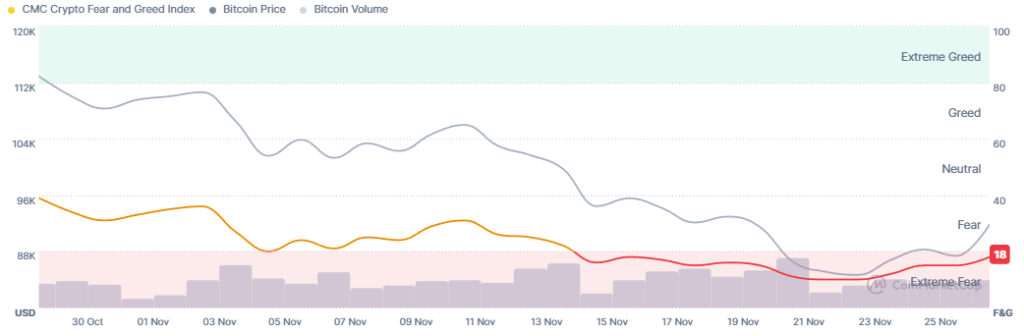

According to Glassnode, the market is prone to keep in a low-conviction consolidation till worth reclaims key cost-basis ranges and new inflows return.

“Bitcoin just isn’t in full capitulation however stays firmly in a low-liquidity, low-conviction setting. Until worth reclaims main cost-basis ranges and recent demand returns, the market is prone to keep in a defensive consolidation section,” the analysts say.

Additionally, Przemysław Kral, CEO of zondacrypto, mentioned that the worldwide ‘risk-off’ macro setting and swell of leveraged promoting has finally served as a needed structural cleanse for Bitcoin.

“This deleveraging occasion eliminated most of the short-term, speculative gamers and made manner for long-term traders, together with institutional traders and hodlers, who’ve been accumulating Bitcoin strategically in the course of the market dip,” Kral mentioned in an e mail remark.

“The ensuing rebound of Bitcoin from multi-market lows, regardless of a perceived local weather of ‘excessive worry’, alerts the deep conviction within the asset’s underlying worth and its continued resilience because the business continues to mature.”

Moreover, Bitunix analysts commented that markets broadly anticipate policymakers to fiercely debate between a “third fee lower” and holding charges unchanged.

“The dominant market driver has shifted from coverage course to the interaction between ‘inflation stickiness vs. financial slowdown,” the analysts say. “Current worth construction reveals bulls and bears battling round key liquidity zones.”

They concluded that “traders ought to monitor the rising danger of volatility forward of the [US] December assembly and pay shut consideration to how strongly capital absorbs worth strikes close to the higher vary—an vital sign of evolving danger urge for food.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC stood at $91,506. The coin jumped from $86,448 to $90,334. After that, it hit the intraday high of $91,849.

In the previous week, the worth moved between $82,175 and $92,032. It’s nonetheless down 0.7% on this timeframe. It’s additionally down 20% in a month and 27.3% from the all-time high.

Bitcoin is stabilizing after a steep correction. A breakout above $93,966 might open doorways in direction of $97,135 and even perhaps $102,255.

UPDATE: Just 7 days in the past, markets priced a December fee lower at 30%. Today? 85% even

UPDATE: Just 7 days in the past, markets priced a December fee lower at 30%. Today? 85% even  NY Fed’s Williams (Powell’s right-hand) signaled openness to cuts

NY Fed’s Williams (Powell’s right-hand) signaled openness to cuts

Strategy has launched a brand new credit standing gauge to calm debt considerations after the Bitcoin crash!

Strategy has launched a brand new credit standing gauge to calm debt considerations after the Bitcoin crash!