Why Is Crypto Up Today? – September 17, 2025

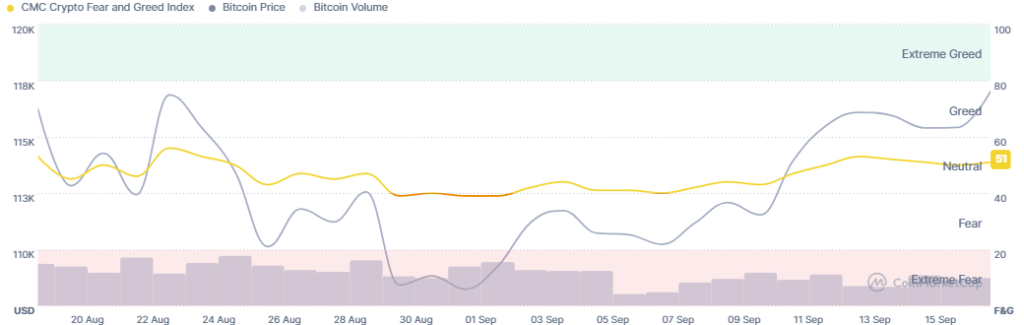

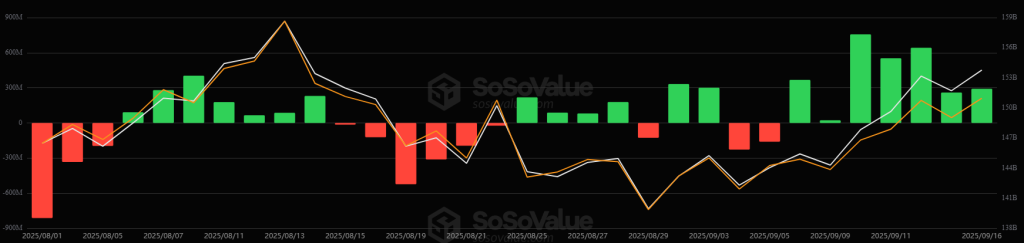

The crypto market is up right now, with the cryptocurrency market capitalization growing 1.1% and again to $4.16 trillion. Most of the highest 100 cash have appreciated over the previous 24 hours. At the identical time, the full crypto buying and selling quantity is at $146 billion.

Crypto Winners & Losers

At the time of writing, 9 of the highest 10 cash per market capitalization have decreased over the previous 24 hours.

is up 0.9%, now altering palms at $4,544.

The highest enhance is 2.8% by Binance Coin (BNB). It at the moment trades at $954.

XRP recorded the second-highest rise of 1.5% to $3.02.

The solely coin that stands within the pink is Tron (TRX), having dropped by 1.1% to the worth of $0.3419.

When it involves the highest 100 cash, 16 cash are pink. The highest amongst these is 5.1% by Pump.fun (PUMP), buying and selling at $0.007873.

It’s adopted by Provenance Blockchain (HASH)’s 2.4% to $0.03672.

On the opposite aspect, the most important gainer right now is MYX Finance (MYX), having appreciated 43.2% to $15.65.

Sky (SKY) is the one different coin with a double-digit rise: 10.5% to $0.07635.

Meanwhile, the Ether Machine, an Ethereum-focused treasury administration agency, has filed a draft registration statement with the US Securities and Exchange Commission (SEC), looking for to go public through a SPAC merger with Dynamix Corporation.

‘Lower Interest Rates May Lead to Increased Prices of the Major Blue-Chip Coins’

On 17 September, the US Federal Reserve will announce the newest charge determination, with markets broadly anticipating a 25 foundation level minimize, Bitunix analysts say.

They argue that, “merchants are suggested to handle leverage rigorously and watch BTC’s key technical ranges: resistance at 117,000 and assist at 115,000. A dovish end result might propel BTC towards the 118,000 liquidation zone, whereas a hawkish tilt might set off a pointy pullback.”

Karel Kubat, co-founder and CEO at Union Labs, explains that “if historical past is any information, markets have a tendency to indicate power for as much as a 12 months after the Fed’s first charge minimize, however that doesn’t imply there gained’t be volatility instantly across the coverage change.”

“What issues for crypto now is not only the macro tailwinds, however whether or not the present and future state of infrastructure, composability, and interoperability can assist renewed capital flows with out risking fragmentation or instability. These are sometimes understated, however they’re important necessities for institutional cash to enter and transfer at scale,” Kubat concludes.

Yet, Samantha Bohbot, Partner and Chief Growth Officer at RockawayX, famous that the FOMC assembly could also be “much less a few shocking FED determination, however extra about [Chairman Jerome] Powell’s feedback.” Any hawkish feedback would possibly result in repricing and a sell-off.

“In such an unsure surroundings, it’s usually good to both settle for the elevated volatility for high conviction bets or lower the funding publicity across the occasion,” she says. “Decreasing publicity solely introduces the chance value of not being totally available in the market within the case of a constructive shock. It additionally offers an investor extra dry powder to deploy through the sell-off at a extra cheap value. We see the hedging with choices as too expensive, because the volatility is normally priced in.”

Bohbot continues: “Lower rates of interest enhance the liquidity in circulation, and traders deploy capital into extra dangerous property comparable to shares and crypto. This ought to result in elevated costs of the foremost blue-chip crypto property comparable to BTC, ETH, and SOL, the place BTC is the asset that’s influenced by liquidity outlooks essentially the most.”

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC trades at $117,255. There was a surge earlier within the day from the intraday low of $114,866 to the intraday high of $117,292.

The coin is again in inexperienced throughout the 24-hour, 7-day, and 1-month timeframes. It might now proceed to climb, surpassing $118,500 and probably shifting to $120,000. Conversely, a drop beneath $116,000 might lead it bac right down to the $114,000 zone.

Banco Santander’s Openbank has launched retail crypto buying and selling in Germany with 5 tokens, with plans to carry the service to Spain subsequent.

Banco Santander’s Openbank has launched retail crypto buying and selling in Germany with 5 tokens, with plans to carry the service to Spain subsequent.